The 'Fear and Greed Index' is developed by CNNMoney to gauge market sentiments. It's based on 2

The Index accumulates data from multiple sources to generate a number. This number is measured on a scale ranging from 0 to 100, where 0 indicates maximum fear and 100 total greed. Within the 0 to.

The Ultimate Guide To The Fear & Greed Index YouTube

The Fear and Greed Index (developed by CNN Business. [1] ) is a measure of investor sentiment, which ranges from extreme fear to extreme greed. The thinking is that "excessive fear" leads to lower.

Der Fear and Greed Index und seine Bedeutung im Optionshandel

Using The Fear And Greed Index To Inform Your Investments. Generally, you can use the Fear and Greed Index, along with other cues, in two ways. First, the index may help you understand how.

Bitcoin BTC Fear and Greed Index Today [Daily Updates] Kalen Houck

The Fear and Greed Index is a sentiment analysis tool for Bitcoin and crypto markets, indicating when markets are overly fearful (potentially undervalued) or greedy (possibly overvalued). It guides investors and traders to make informed decisions, balancing their emotions against market trends. This index, ranging from 0 (fear) to 100 (greed.

Qué es el "Índice de Miedo y Codicia" y cómo utilizarlo para medir el sentimiento de los

The Fear and Greed Index collates seven measures of market sentiment to generate one number, which gives a numerical description of the mood of the markets. Monitoring the confidence levels of market participants is important because investor behaviour can, at times, be irrational, which can cause prices to overshoot in one direction or another.

The Fear & Greed Index What It Is and How It Works

:max_bytes(150000):strip_icc()/Term-Definitions_Fear-and-greed-index-Final-v2-d7806b62716e495a8b3868a2d3db754f.jpg)

The Fear & Greed Index uses slowing momentum as a signal for Fear and a growing momentum for Greed. stock price strength. Net new 52-week highs and lows on the NYSE. A few big stocks can skew returns for the market. It's important to also know how many stocks are doing well versus those that are struggling.

The Emotion Driving the Market

Following massive million-dollar liquidations in the past few days, an additional $470 million was liquidated. The price of Bitcoin fell to $57,000 on Wednesday, down 9% in 24 hours and 13% in a week. The Crypto Fear and Greed Index also dropped from 67 (greed) to 54 (neutral) in a day.

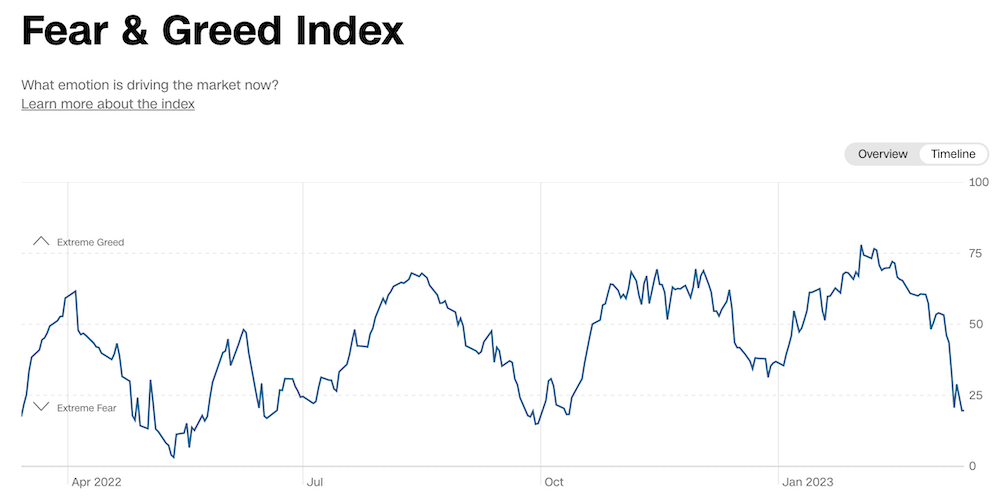

Fear and Greed Index What emotion is driving the market now? Neutral Now Extreme Fear 50 25

The CNN Fear and Greed Index is a composite index of sentiment-related variables for the US stock market. These variables include: market momentum, stock price strength, stock price breadth, put and call options, market volatility, safe haven demand, and junk bond demand. The index calculates how much each individual variable deviates from its average and assigns equal weights to each variable.

Fear and Greed Index The Howto Guide Phemex Academy

The Fear & Greed Index, through its seven distinct indicators, attempts to quantify these emotional influences on the market. For instance, during significant market events like the 2008 financial crisis or the 2020 COVID-19 pandemic, this index reflected extreme fear, correlating with substantial drops in stock prices.

What Is the Crypto Fear and Greed Index?

What is the fear and greed index? At its core, the fear and greed index is a barometer for any market's emotional temperature. Designed to quantify the two most potent emotions driving investors.

Fear vs Greed Index Importance, Calculation & Application

Introduction. Our project redefines the Fear and Greed Index by harnessing advanced AI algorithms to analyze and interpret market sentiments across cryptocurrencies. By aggregating data from influential voices on Twitter, Discord, and Reddit, we provide a nuanced view of the emotional landscape governing the crypto market.

Crypto Fear And Greed Index, Explained

Fear And Greed Index Example. The Fear and Greed Index may be interpreted at various levels: 1. Extreme Fear (0-20) 2. Fear (21-40) 3. Neutral (41-60) 4. Greed (61-80) 5. Extreme Greed (81-100) Let's consider a numerical example of the Index calculated using a combination of indicators with arbitrary weights:

CNN Money’s Fear & Greed Index “Greed” Continues to Drive the Market eResearch

The index is based on various factors and indicators, such as stock market performance, market volatility, investor surveys, and more. The Fear and Greed Index normally has a value between 0 and 100, where excessive greed is represented by higher values and severe fear by lower values. High numbers imply that investors are optimistic and may be.

What is the Fear and Greed Index and How Does it Measure Market Sentiment? Funded Trading

Fear is what drives investors to flee the market in panic when it turns bearish, and greed is often at the root of "irrational exuberance" that can lead to stock market bubbles. When those.

Use Inverse ETFs to Profit From a Market Pullback

The Fear and Greed Index categorizes sentiment into four ranges: Extreme Fear (0-24, orange): This range indicates that the market is in a state of extreme fear. Fear (25-49, yellow): The market is experiencing fear, although prices may not be at their lowest. Greed (50-74, light green): Market greed is prevalent, with many investors buying.

New to crypto investment? Should you be using Fear and Greed index?

The Fear & Greed Index is a compilation of seven different indicators that measure some aspect of stock market behavior. They are market momentum, stock price strength, stock price breadth, put.